Japan is the world’s third largest economy which makes it extremely relevant in terms of the international community’s major economic players. Here you can find both general information on Japan’s economy and recent headlines that have affected Japan’s success in the global economy. Managers can explore key aspects of the country’s general economy including their currency, state of GDP/GNP, bankruptcy, and interest rates.

As globalization ties more and more countries together, imports and exports can often make or break the success of a country’s economy. Dependant on a country’s resources, the need to import, or ability to export, can become an essential factor for an economy. This page will also allow managers to have an insight of the role that importing and exporting goods and services plays in Japan’s Economy.

Current News Affecting the Economy

Prime Minister Shinzo Abe’s economic plan deemed ‘’Abenomics’’

Japan’s central bank has announced that it has extended its estimated timing to reach Prime Minister Abe’s goal of a 2.0% inflation rate by March 2016 a second time. Just a few weeks after being elected, Prime Minister Abe announced his plan to bring Japan’s economy out of its stagnant state in the goal of increasing “domestic demand and gross domestic product (GDP) growth while raising inflation to 2 percent.” (1) Initially, inflation did increase, suggesting that Abe’s rigorous restructuring and monetary and fiscal policies was working. However, due to factors like weakening oil prices, continued progress in the future became less hopeful. With increasing debt, analysts are becoming worried that Japan will again face deflation in 2015.

“Earlier this year, the Bank of Japan (BOJ) announced that “Japan’s economy would expand 1.7 percent in the fiscal year to March 2016 while inflation would come in at 0.7 percent.” Although the economy did expand 1% between January and March 2015 (an increase from the recession in the final quarter of 2014) (2) , consumer spending has not performed as well as expected due to the increasing sales tax implemented last year. Household spending is a key element of the PM’s plan to better the state of the economy. As of September 2015, spending had dropped another 0.4 percent (3). Although the government remains positive, economists worldwide are skeptical of Abe’s approach to breaking Japan’s multi-decade inflation slump”.

Photo from http://www.japan-guide.com/e/e2450_how.html

General Economy

Currency

The Japanese yen (JPY) is the official currency of Japan and is also the third most traded currency on the forex market, behind the US dollar and the euro. From 2010 to 2013, the Foreign Exchange Market saw a shift of the most actively traded currencies. Among these, the Japanese yen stood out the most with a 68% increase in trading activity, while at the same time the Euro’s role in international currency trade declined (4). The country also has “managed floats” that allow their local currency to fluctuate within a limited range over time as part of a larger economic policy (5).

In 2013 as a part of an economic policy implemented by Shinzo Abe’s Abenomics, Japan’s Central Bank has unveiled a massive program worth 1.4billion USD that will double the country’s monetary supply (6). Japan’s plan is to purchase large government bonds with values of 7 trillion yen per month (Approx. $75,000,000 CDN) (6). These would be purchased using electronically created money in aims of reigniting demand, as well as pushing up wages and prices. The second year plan was for inflation to be pushed up to 2%, which was achieved in 2014 with their highest rate in recent years of just under 4%, but has now slowed down to only 0.2% inflation in 2015 (7). The economy overall isn’t doing too bad. The number of employed persons in September 2015 was 64.39 million, an increase of 370 thousand or 0.6% from the previous year (8). The number of unemployed persons in September 2015 was 2.27 million, a decrease of 60 thousand or 2.6% from the previous year, and the unemployment rate, seasonally adjusted, was 3.4% (8).

Bankruptcy

Japan is currently doing well on an economic level when compared to previous years and is not close to bankruptcy at all. They have copied the US monetary system meaning they cannot simply “run out of money” (http://www.pragcap.com/japan-isnt-bankrupt/).

The country is currently looking to expand their international presence in Central Asia in order for them to have a more stable business and economic environment. Their hopes for this is to decrease their dependency on China and Russia. This expansive search includes both public and private-sector investment deals that mainly hope to increase the exporting opportunities available to Japanese firms. The program has been welcomed with open arms by the countries of central Asia who are currently suffering from the side effect of the current depression in Russia. The countries in the area are interested in finding new trading partners, and with Japan’s major tour through this area, it seems to be a lucrative deal for both parties. With some major deals already in place, Japan is on a mission to find new trading partners.

Some current deals include a US$ 18 billion worth of investments in Turkmenistan in the energy, chemical, and power sectors (9). This includes a deal in which Japanese firms, JGC Corporation and Mitsubishi, will work to develop the Galkynysh gas field and the Turkmenbashi port. In Uzbekistan US$ 8.5 billion worth of investment is being put into their energy, communications, and transportation sector (9). Japanese firms will also be given access to a partnership with the state-owned oil and gas holding company Uzbekneftegaz. Japan has offered aid to Kyrgyz Republic of US$ 1 billion for the use of boosting infrastructure and granting a low interest loan agreement (9). A similar term of investment has been made with Tajikistan to boost infrastructure. The investment has been quoted at US$ 7,000,000. The country is also currently in talk with Kazakhstan over the investment in such sectors as nuclear, banking, agriculture, and transportation (10).

GDP vs. GNP

Gross Domestic Product (GDP), at Current Prices – National currency

Gross National Income, National Currency

Japan’s GDP in 2014 was 4,602,367 million US$, putting them in 3rd place, just under the USA and China respectively. Japan also ranks 4th in terms of PPP in comparison to the world. When comparing the GDP to GNP, one will notice that GNP is always greater than GDP. This means that Japan is more focused of the outward flow of investment and advantages that come with it. This is due to the fact that there is more money being made around the world by the Japanese people, in comparison to the amount of money being made in Japan by Japanese people and foreigners.

| Year | GDP (JPY) | GNP (JPY) |

| 1998 | 512,438,600,000,000 | 519,390,400,000,000 |

| 1999 | 504,903,200,000,000 | 511,280,100,000,000 |

| 2000 | 509,860,000,000,000 | 516,339,700,000,000 |

| 2001 | 505,543,200,000,000 | 513,932,500,000,000 |

| 2002 | 499,147,000,000,000 | 507,188,700,000,000 |

| 2003 | 498,854,800,000,000 | 507,116,900,000,000 |

| 2004 | 503,725,300,000,000 | 513,111,800,000,000 |

| 2005 | 503,903,000,000,000 | 515,652,400,000,000 |

| 2006 | 506,687,000,000,000 | 521,151,600,000,000 |

| 2007 | 512,975,200,000,000 | 530,313,100,000,000 |

| 2008 | 501,209,300,000,000 | 518,002,300,000,000 |

| 2009 | 471,138,700,000,000 | 484,216,400,000,000 |

| 2010 | 482,384,400,000,000 | 495,358,700,000,000 |

| 2011 | 471,310,800,000,000 | 485,985,900,000,000 |

| 2012 | 473,784,400,000,000 | 488,829,200,000,000 |

Therefore, the interactions that Japan will have with most foreign countries will likely occur in the foreign country. At the same time, what can been seen in the GNP vs. GDP table is that the amounts are never farther than 5% away from each other. Therefore, they are fairly balanced in terms of doing business abroad and bringing business in. (file:///C:/Users/User/Videos/Ratio%20of%20GNP%20to%20GDP%20for%20Japan%20-%20FRED%20-%20St.%20Louis%20Fed.html)

Surplus vs. Deficit

Due to the high cost of the BOJ program, Japan’s public debt has slowly been increasing. However, the program goes through bi-annual meetings in order to reduce this debt. Just recently on October 30th 2015, the monetary policy board voted 8-1 in favour of leaving the policy setting unchanged (10).

| In terms of Billion US$ | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

| General government budget revenue | 32.4 | 33.0 | 33.1 | 33.9 | 34.6 | 35.1 | 35.5 |

| General government budget expenditure | 40.7 | 41.8 | 41.8 | 42.3 | 42.3 | 41.6 | 41.4 |

| General government budget balance | -8.3 | -8.8 | -8.7 | -8.5 | -7.7 | -6.5 | -5.9 |

| Public debt | 193.2 | 209.4 | 215.4 | 220.3 | 226.0 | 227.9 | 229.8 |

This policy was unchanged despite reports showing that there would be major changes in policy due to the large amount of data showing a weakening in economic activity during the third quarter of 2015. The monetary policy team is under the belief that holding the current asset-purchasing program will further stimulate the economy (11).

Interest Rates

In Japan, interest rates are set by the Bank of Japan’s Policy Board in its Monetary Policy Meetings. Monetary Policy Meetings produce a guideline for money market operations in inter-meeting periods. This guideline is written in terms of a target for the uncollateralized overnight call rate (12). The current rate set by the bank of japan ranges from 0%-0.1%. It has seen little change from this number since 2008 when the rate moved from 0.3% to what it is now. The Bank of Japan continues to keep the interest rate set at a very low level to support the healthy development of the nation’s economy by ensuring price stability.

Imports and Exports

Exports

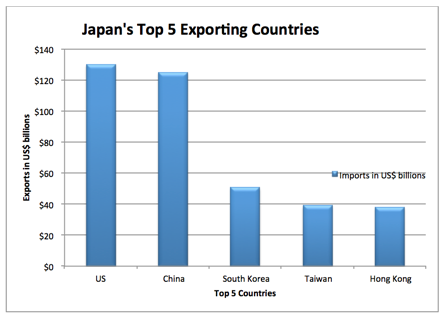

Top 5 Countries Japan Exports To:

- United States: US$130 billion (19%)

- China: $125 billion (18.3%)

- South Korea: $50.5 billion (7.4%)

- Taiwan: $38.9 billion (5.7%)

- Hong Kong: $37.8 billion (5.5%)

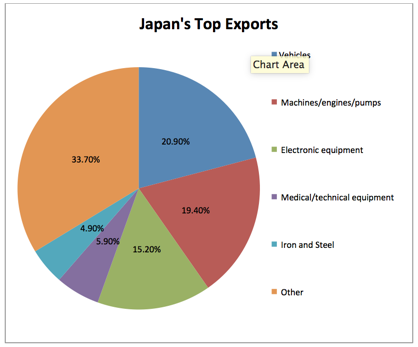

Top 5 Export Industries for Japan:

- Vehicles: US$142.7 billion (20.9% of total exports)

- Machines, engines, pumps: $132.6 billion (19.4%)

- Electronic equipment: $104.2 billion (15.2%)

- Medical, technical equipment: $40.4 billion (5.9%)

- Iron and steel: $33.4 billion (4.9%)

- Other (33.7%)

Imports

Top 5 Countries Japan Imports From:

- United States: $72,509

- China (inc. Hong Kong): $55,100

- South Korea: $20,446

- Indonesia: $16,380

- 5. Australia: $14,800

|

Top 5 Industries Japan Imports From:

- Oil: $262.8 billion (32.3%)

- Electronic equipment: $99 billion (12.2%)

- Machines: $65.1 billion (8%)

- Ores, slag, ash: $30.3 billion (3.7%)

- Medical equipment: $24.8 billion (3.1%)

Imports And Exports Comparison

Imports Vs Exports rates for the last 10 years

Business Economy

Property Rights

With respect to property rights within the country of Japan, a useful tool to start your search comes from the property rights index. This compares Japan to the rest of the continent with respect to the degree to which a country’s laws protect private property rights, and the degree to which its government enforces those laws (14). A higher score is more desirable, and is ranked on a scale from 0-10.

| Year | Score |

| 2007 | 7.7 |

| 2008 | 7.8 |

| 2009 | 7.7 |

| 2010 | 7.6 |

| 2011 | 7.6 |

| 2012 | 7.7 |

| 2013 | 7.7 |

| 2014 | 7.8 |

(2)

The good news about Japan is the steadiness of their International Property Rights Index ranking (IPRI). Furthermore, they rank 3rd in their continent, behind only Hong Kong and Singapore (14). From the standpoint of an expatriate or business entering the Japanese market, it is noteworthy that this ranking also considers the ability of individuals and businesses to enforce contracts.

Incentives to Invest

Although Japan’s economy was crippled after WWII, the period of 1960-1980 has been described as an economic miracle for Japan, largely due to their technological expansion (16). In current day Japan, the automobile industry produces the 2nd largest amount of vehicles in the world (China). Also, Japan is the world leader in electronics manufacturing with many large companies. Regardless, services still dominate the economy, contributing to 71.4% of the GDP (16). A number of these service industries that may offer enticing opportunities to businesses looking to expand include banking, insurance, retailing, transportation, and telecommunications. Japan is home to 326 companies from the Forbes Global 2000 and is also home to the world’s third largest stock exchange by market capitalization (US$3.3 Trillion), the Tokyo Stock Exchange (16).

(17) Government Imposed Restrictions on Expansion

Exchange Rates($ CAD/YEN ¥)

The Japanese Yen is used widely, currently the exchange rate sits at 1 Yen to CAD$0.011 and 1 Yen to USD$0.0081. An interesting aspect to consider for expatriates is the fact that there is no limit on the amount of currency that may be brought into or taken out of the country, and a customs declaration must only be completed when transporting amounts exceeding 1,000,000 Yen worth (18).

Investment Inflow

Moreover from the video above, increasing FDI in Japan is a big priority for the Abe administration. For example, the growth strategy calls for increasing the amount of FDI in Japan to 35 Trillion Yen by 2020 (doubled from 2014) (19). In addition to the policy changes necessary for this, the Abe administration also plans to cut the corporate tax rate to a level more common in many European and Asian economies, with the goal of attracting more FDI to Japan (19).

Evidently steps are being taken to increase FDI, along the way easing the ability of foreign companies and expatriates to do business in Japan. This should increase FDI, while also making it more incentivized for local firms to increase domestic investment. Attempts are being made to increase economic growth, and free trade agreements will further increase the potential for increased FDI and economic growth. Japan and Canada are currently engaged in free trade agreement negotiations (20).

Work Cited

(2) Business Insider. (2015, 07 15). Bank of Japan still limps out of a recession with a cut in its annual economic growth forecast. Retrieved 11 08, 2015, from Business Insider: http://www.businessinsider.com/afp-bank-of-japan-cuts-annual-economic-growth-inflation-forecasts-2015-7

(1) Council on Foreign Relations. (2015, 03 10). CFR Backgrounders: Abenomics and the Japanese Economy. Retrieved 11 08, 2015, from Council on Foreign Relations: http://www.cfr.org/japan/abenomics-japanese-economy/p30383

(3) Fox News. (2015, 10 29). Japan sees drop in core inflation rate as central bank mulls more easing . Retrieved 11 08, 2015, from Fox News World: http://www.foxnews.com/world/2015/10/29/japan-sees-drop-in-core-inflation-rate-as-central-bank-mulls-more-easing/

(4) “Triennial Central Bank Survey.” Bank For International Settlements. September 1, 2013. Accessed November 9, 2015. http://www.bis.org/publ/rpfx13fx.pdf.

(5) Martin, Michael. “East Asia’s Foreign Exchange Rate Policies.” CRS Report for Congress. April 10, 2008. Accessed November 9, 2015. https://www.fas.org/sgp/crs/row/RS22860.pdf.

(6) Stewart, Heather. “Japan Aim to Jump-start Economy $1.4tn of Quantitative Easing.” The Guardian, April 4, 2013. Accessed November 7, 2015. http://www.theguardian.com/business/2013/apr/04/japan-quantitative-easing-70bn.

(7) “Japan Inflation Rate | 1958-2015 | Data | Chart | Calendar | Forecast.” Japan Inflation Rate | 1958-2015 | Data | Chart | Calendar | Forecast. Accessed November 9, 2015. http://www.tradingeconomics.com/japan/inflation-cpi.

(8) “Monthly Results -September 2015-.” Statistics Bureau Home Page/Labour Force Survey/. October 30, 2013. Accessed November 9, 2015. http://www.stat.go.jp/english/data/roudou/results/month/index.htm.

(9) “Ratio of GNP to GDP for Japan.” Federal Reserve Bank of St. Louis Economic Data – FRED. April 3, 2014. Accessed November 9, 2015. https://research.stlouisfed.org/fred2/series/GNPGDPJPA156NUPN.

(10) “Japan Pledges US$26bn Investment in Central Asia.” The Economist Intelligence Unit. November 2, 2015. Accessed November 9, 2015. http://country.eiu.com.proxy.library.carleton.ca/article.aspx?articleid=2023643986&Country=Japan&topic=Economy&subtopic=Forecast&subsubtopic=Foreign direct investment.

(11) “BOJ Keeps Monetary Policy Steady.” BOJ Keeps Monetary Policy Steady. October 30, 2015. Accessed November 9, 2015. http://country.eiu.com.proxy.library.carleton.ca/article.aspx?articleid=1623639146&Country=Japan&topic=Economy&subtopic=Forecast&subsubtopic=Monetary policy outlook&u=1&pid=953588679&oid=953588679&uid=1.

(12) “Japan Interest Rate | 1972-2015 | Data | Chart | Calendar | Forecast | News.” Japan Interest Rate | 1972-2015 | Data | Chart | Calendar | Forecast | News. Accessed November 9, 2015. http://www.tradingeconomics.com/japan/interest-rate.

(13) “XE Currency Charts.” XE.com. November 9, 2015. Accessed November 9, 2015. http://www.xe.com/currencycharts/?from=USD&to=JPY&view=10Y.

(14) IPRI. (n.d.). Retrieved November 9, 2015, from http://www.globalpropertyguide.com/Asia/japan/property-rights-index.

(15) “IPRI 2014.” IPRI 2014. Accessed Novemney.html

(19) Increasing FDI in Japan | The Japan Times. (2014, July 23). Retrieved November 9, 2015, from http://www.japantimes.co.jp/opinion/2014/07/23/editorials/increasing-fdi-japan/#.VkALYrerTIU

(20) Canada-Japan Economic Partnership Agreement. (n.d.). Retrieved November 9, 2015, from http://www.international.gc.ca/trade-agreements-accords-commerciaux/agr-acc/japan-japon/index.aspx?lang=eng

ber 9, 2015. http://internationalpropertyrightsindex.org/country?c=Japan.

(16) Japan Industry Sectors. (2013, June 4). Retrieved November 9, 2015, from http://www.economywatch.com/world_economy/japan/industry-sector-industries.html

(17) Export to Japan. (n.d.). Retrieved November 9, 2015, from http://www.exporttojapan.co.uk/videos/abenomics-and-more-open-japan

(18) Money. (n.d.). Retrieved November 9, 2015, from http://www.jnto.go.jp/eng/arrange/essential/mo

(19) Workman, Daniel. “Japan’s Top Import Partners – World’s Top Exports.” Worlds Top Exports. November 6, 2015. Accessed November 10, 2015. http://www.worldstopexports.com/japans-top-import-partners/2082

(20) Workman, Daniel. “Japan’s Top 10 Exports – World’s Top Exports.” Worlds Top Exports. October 27, 2015. Accessed November 10, 2015. http://www.worldstopexports.com/japans-top-10-exports/2097

(21) Japan – Foreign Trade.” Foreign Trade. Accessed November 10, 2015. http://www.nationsencyclopedia.com/Asia-and-Oceania/Japan-FOREIGN-TRADE.html

(22) Workman, Daniel. “Top Japan Imports.” Top Japan Imports. Accessed November 10, 2015. http://www.worldsrichestcountries.com/top_japan_imports.html.

(Image 1)

McBride, James. “CFR Backgrounders.” Council on Foreign Relations. March 10, 2015. Accessed November 9, 2015. http://www.cfr.org/japan/abenomics-japanese-economy/p30383.